Nifty 50 continued to experience weakness as it followed global equity markets which are experiencing selling pressure. Last week Nifty lost around 4.2% mainly due to heavy selling experienced in banking/finance, auto and pharma stocks. Among the heavyweights, Bajaj Finance & Bajaj Finserv lost 10.06% and 8.52% respectively, Eicher motors fell by 10.18% and Divi’s Lab by 7.54%. Continuing selling by FIIs as liquidity fears creep in, due to the increase in US’s interest rates and continuing war between Ukraine and Russia is adding to the worries of the investors. We expect the weakness to continue in the forthcoming weeks unless the quarterly results for Q1-2022 show huge improvements in earnings and provide an opportunity for value buying for investors.

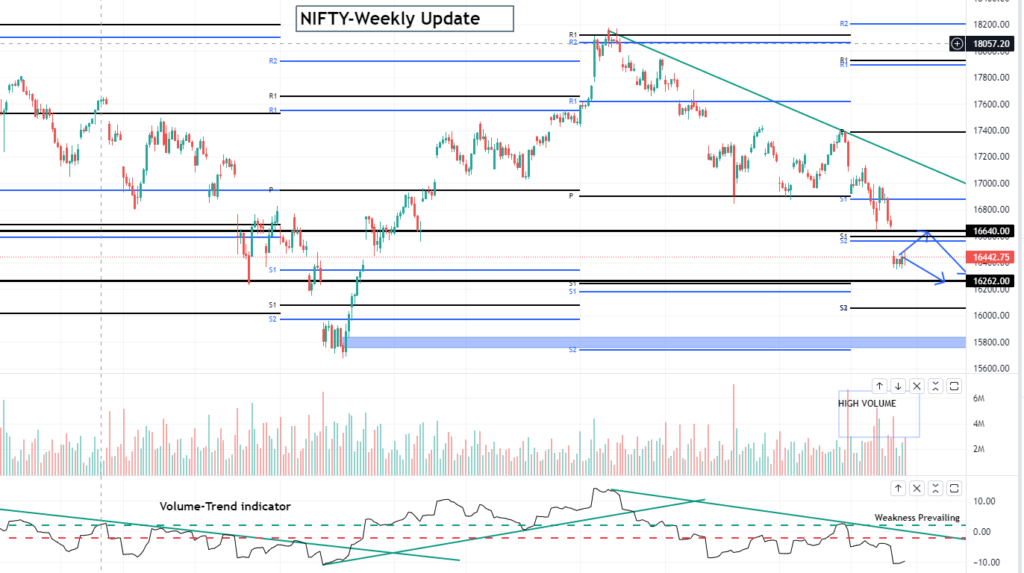

Technically, the Nifty has been in the weak phase since last month. The trendline shows the index forming lower-high and lower-lows indicating selling pressure is being experienced. Last week’s fall was accompanied by heavy volume, so we expect the weakness to prevail unless buying happens with heavy volumes to counter the sellers. At present, the supply zone is placed at 16630-50, hence we expect an initial pullback to 16630-50 levels before the index slips towards the demand zone of 16270-260. Any breach of 16270-260 levels may pull the index towards the major demand zone of 15830-800 levels.

The volume-trend indicator is showing prevailing weakness and only an upside breach of the trendline will confirm a change of trend.