Nifty 50 experienced buying at major support (as expected) last week as it failed to breach the level of 15740-720 and experienced some buying to close the week with a weekly gain of 3.07%. The weekly rally in the index was supported by banking, pharma and metal stocks. Among the heavyweights in these specific sectors Axis Bank & ICICI Bank gained 5.84% and 4.75% respectively. Among the pharma stocks, Cipla and Sun Pharma gained 4.69% and 3.76% respectively. In the metal sector, Hindalco and Tata Steel gained 10.59% and 6.71%.

Though the economic fundamentals seem unchanged, most of the heavy-weight stocks seem to have hit prominent technical support levels that induced buying.

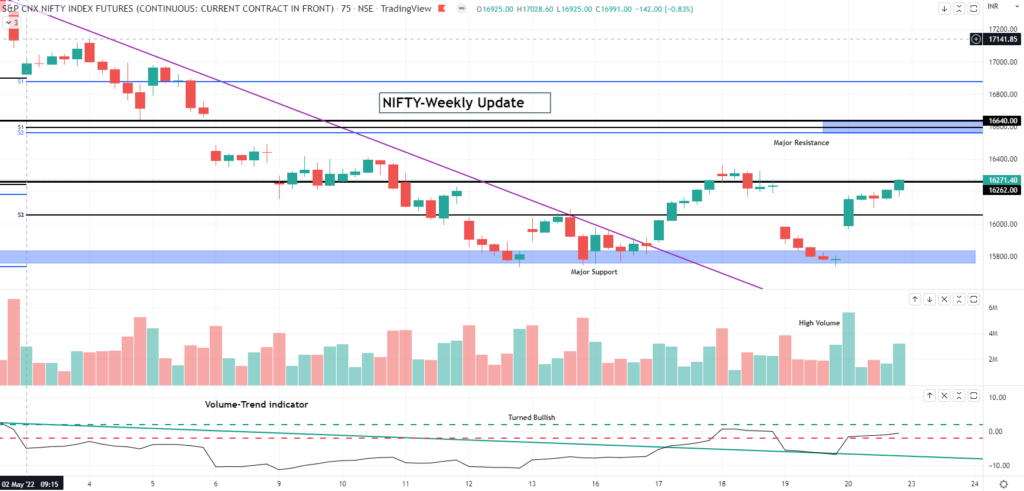

Technically, Nifty experienced buying at the major demand zone and for most of the week was range-bound in between the demand and supply zones (15740/50-16260/80). Nifty’s movement last week to a great extent was in line with our volume-based analysis (check it out). Last week’s volume of around 1.24 million contracts was above average and being accompanied by bullish undertones provide some support for further upside for the index this week. Any confirmatory breakout (breakout with considerable volume) of the present demand zone 16300-320 may initiate a rally towards the first supply zone of 15600/650 and further towards 16900.

The volume-trend indicator (TWV’s proprietary indicator) is showing some strength as it breached and sustained above the bearish trend line.

Nifty Weekly Updated for 23rd-27th May 2022. (Tweet This)