Nifty 50 experienced volatility last week as it experienced selling pressure at higher levels and some buying at demand zones, as a result, Nifty futures closed at 16601 with a gain of 1.62%. The bullish trend was supported by Reliance Industries, IT sector stocks, and Metal stocks. Reliance Industries gained around 7.94%. Among the IT heavyweights, TCS and Infosys gained 5.48% and 4.13% respectively and among the metal stocks, JSW Steel and Tata Steel gained 2.56% and 2.28% respectively.

Positive global cues coupled with favorable updates on monsoon progress is expected to keep the market sentiments bullish.

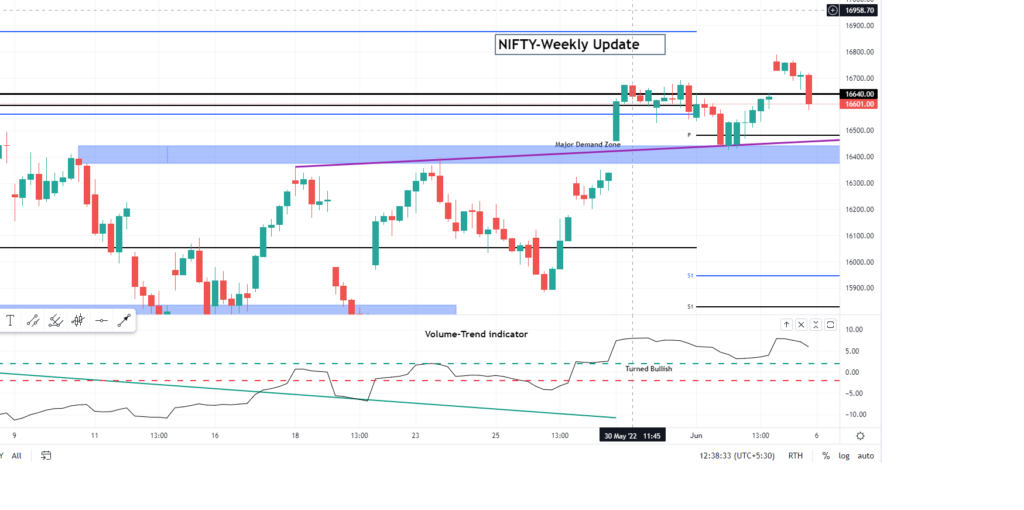

Technically, Nifty is in a bullish phase and behaving in line with our previous week’s volume-based analysis (check it out). The weekly closure above 16450 is an indication of the bulls are in control of the index. In the initial part of the week the index may experience some fall till 16420-460 (a major demand zone) wherein the bulls may again re-enter and push the index towards the 16900-700. Along the demand zone, a multiple-pivot trendline (see image) is providing support to the index(futures) prices, and the prices may retest it again before it breaches the previous week’s high.

The volume-trend indicator (TWV’s proprietary indicator) is continuing to some strength as it breached and sustained above the bearish trend line and is placed in the bullish zone.