Last Friday (5th January 2024), Nifty 50 futures experienced turbulent intraday movements but closed flat at 21793.95. The major gainers were Adani Ports (2.79%) and TCS(1.94%) respectively whereas major losers were Nestle(-1.67%) and Britannia(-1.66%).

On Friday the volumes remained subdued at 6.75 Million as the index failed to breach the resistance traded flat. The open interest also didn’t experience any major addition into overnight positions and stood at 13.20 Million a mere addition of 2.2% from the previous day.

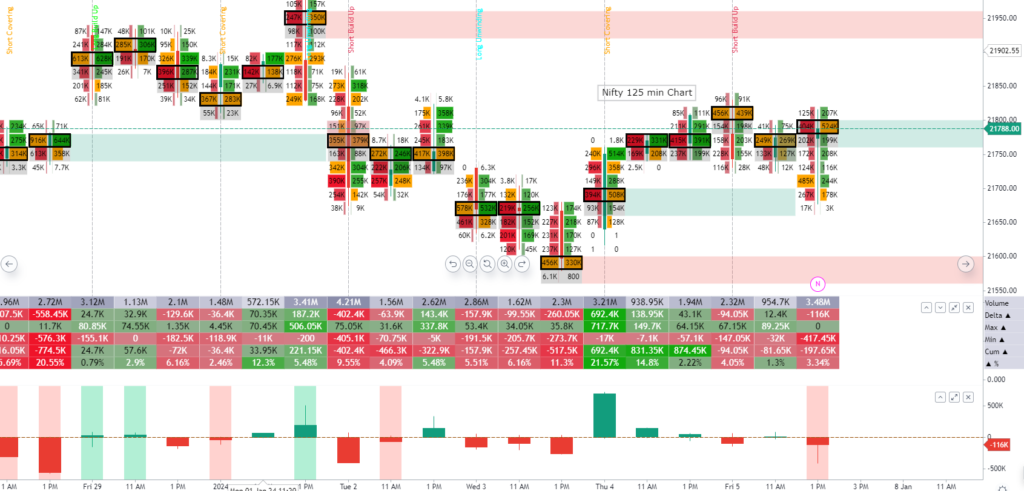

An analysis of the imbalance chart of Nifty (125 minutes) reveals that the futures experienced buying from the previous imbalance zone of 21660-700 in the last candle of the day. It experienced massive selling absorption in the process as the delta moved from -417.45K to a mere -116K. Buying from the previous demand zone supports the majority of traders’ confidence in the buying zone and provides confidence for further upside.

The index may remain bullish in the forthcoming sessions, but a strong resistance zone of 21880-960 may limit its upside. Any breach of the resistance with volumes may start a bull run for the index.

Traders may experience two scenarios in the next few forthcoming sessions.

Scenario 1: Nifty may move towards the resistance (21880-960), breach its larger-than-average volumes, and continue its uptrend.

Scenario 2: Nifty may move towards the resistance (21880-960) and experience some correction from those levels.

**Note: To stay updated with “Nifty futures” updates do join our Telegram channel: https://t.me/twvol