Nifty futures on the first trading day of the year, failed to capitalize on the initial momentum and experienced some selling at higher levels to close almost flat at 21888.9, a gain of 0.01%. The major gainers of the day were Nestle (2.98%) and Adani Enterprises (2.4%) whereas the major losers were Eicher Motors (-2.54%) and Bharati Airtel(-1.86%).

The volumes continued to fall and stood at 5.465 Mil for the day. The cumulative open interest(COI) also experienced some fall as it stood at 13.744 Mil for the day( a fall of 0.5%).

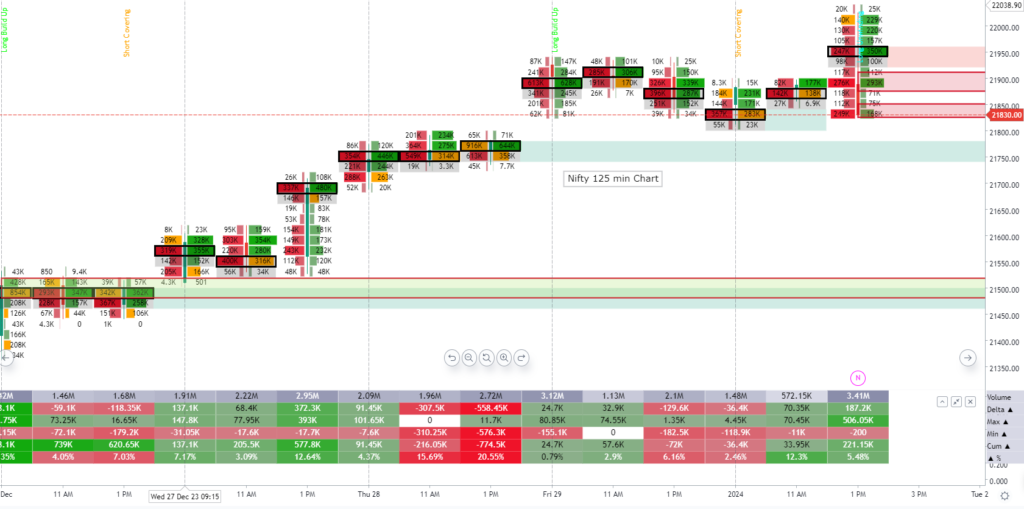

As expected in the weekly analysis, an absence of big volume buyers may limit Nifty’s upside move and rather may push the index toward the demand zones of 21750 and further down toward the major demand zone of 21500.

Monday’s last 125 min candle experienced some sell-off, in the absence of major buyers. It experienced some major buying absorption with above-average volumes thereby supporting the weekly analysis of “expected selling” at higher levels. In the forthcoming sessions, Nifty may experience some selling pushing the index toward the above-mentioned buying zones.

Traders may experience two scenarios in the next few forthcoming sessions.

Scenario 1: Nifty may move towards lower levels of 21750 and if supported by higher volume may move towards 21500.

Scenario 2: Nifty may continue to move higher from present levels if buying persists with “higher volume”.

**Note: To stay updated with “Nifty futures” updates do join our Telegram channel: https://t.me/twvol