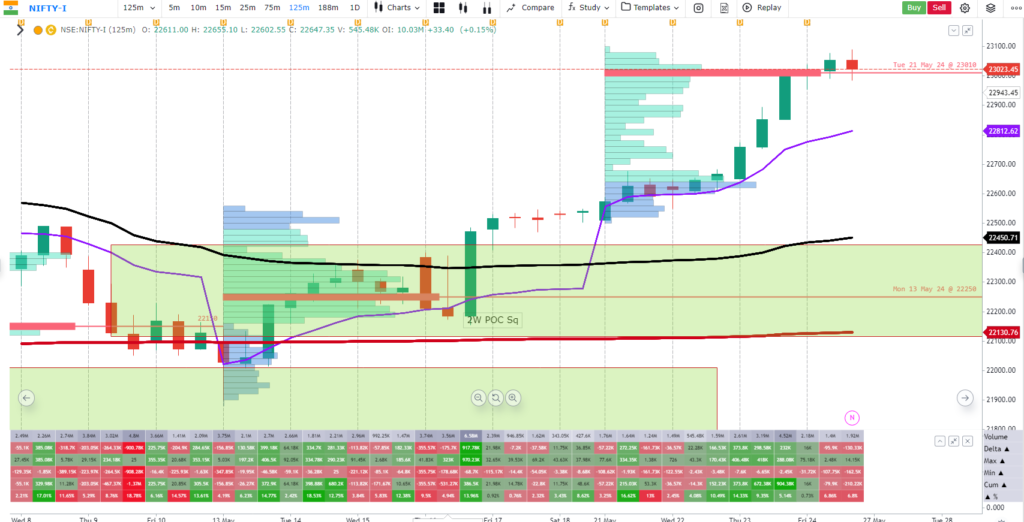

Nifty futures traded strongly last week as it continued its uptrend it started the previous week. On Friday (24th May, 2024) it traded flat to close at 23019.6. The major gainers for the day were HDFC Bank(1.65%), L&T (1.23%) and Bharti Airtel(1.05%).

Volume & OI Analysis: The daily volume in Nifty futures remained low on Friday after a volume burst on Thursday. Friday’s volume stood at 5.5 million, an almost 50% drop in volume from Thursday. The cumulative open interest(COI) showed an addition of open interest for every day of the week supporting a long build-up for the index.

Price and Volume Analysis: Price analysis of Nifty 50 futures indicates further upside but some stagnancy and pull-back in prices may be expected, as the prices failed to sustain above the weekly value area. A pullback towards 22900-850 may be expected (which is a major positive delta zone, from Thursday’s volume breakout) and coincides with the previous week’s VWAP. However further downside seems limited for the index and a breakout of the weekly value area may push the prices toward new highs.

Scenarios: Traders may experience these scenarios in the next few forthcoming sessions

Scenario 1: Prices may fall towards the support of 22900-850 and restart its upward journey towards a new high of 22200-300 during the week.

Scenario 2: Prices may break out the weekly value area of 23089 and continue its upward journey without any signs of correction.

Note: follow us in X(twitter): @volumetrader7

Disclaimer: Tradewithvolume is not an investment adviser registered with SEBI. The information presented here is for educational/analytical purposes. Readers’ discretion is requested for acting on the information. The information presented on the website is not for buying/selling recommendations and is only for informational/educational purposes