Nifty on Saturday (20th Jan) lost around 0.31% to close at 21604. The major losers for the day were Hindustan Unilever(-3.76%), TCS(-2.09%), and Mahindra&Mahindra(-2.01%).

The volume for the day stood at 3.65 Million, which was the least in the last 20 trading days. The cumulative open interest stood at 15.49 Million, higher than the average volume.

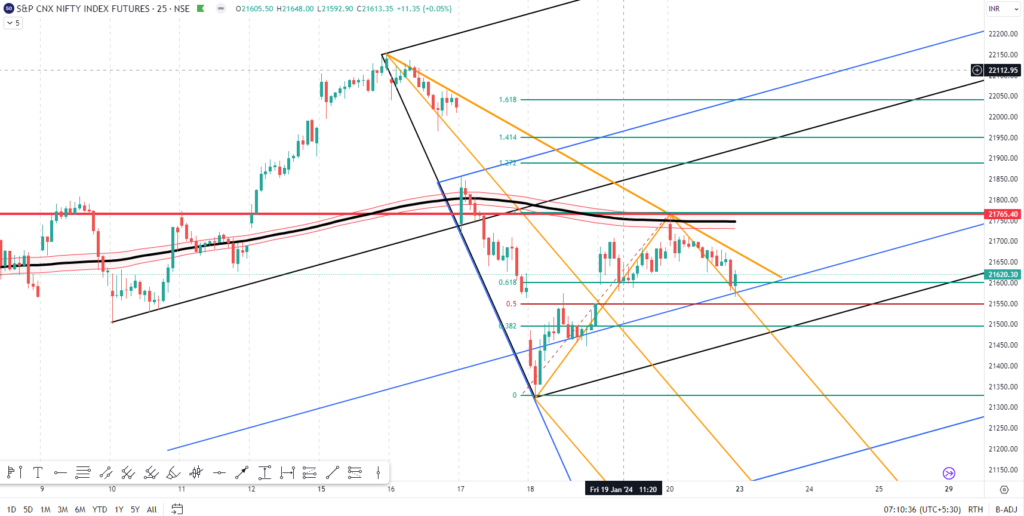

The price analysis of the nifty futures chart indicates that prices are around the support zones (the prices are at 0.618% retracement of the last up move: 21330 to 21755). Any breakout of the trendline with above-average volume may restart the bull run for a few trading sessions.

The “order-flow” chart analysis indicates that Nifty futures failed to sustain the resistance (21720-680) as sellers had selling positions (marked by red color in the chart), but after Saturday’s fall the futures have retraced around the buying zone and any breakout of the resistance with above average volumes may pull the bulls back into the market.

As per the “options” OI analysis, the cumulative OI (OI from the next 2 expiries) for 21500 PE stood at 9.45 Million, the 2nd highest in the option chain, so it seems unlikely that the Nifty futures will fall below the 21500 level.

Traders may experience two scenarios in the next few forthcoming sessions

Scenario 1: Nifty may break the resistance of 21720-680 with above-average volumes and move towards the next resistance of 21820-840

Scenario 2: Nifty may remain range bound around 21550-700 levels

**Note: To stay updated with “Nifty futures”, do join our Telegram channel: http://tinyurl.com/volumetrader

Disclaimer: Tradewithvolume is not an investment adviser registered with SEBI. The information presented here is for educational/analytical purposes. Readers’ discretion is requested for acting on the information. The information presented on the website is not for buying/selling recommendations and is only for informational/educational purposes