Nifty futures last Friday(12th, April) traded weak to close around 22610, thereby losing 1.03%. The major losers for the day were Sun Pharma(-3.99%), Maruti(-3.2%), and Powergrid(-2.58%).

The volume for the day stood at 8.51 Million which was higher than the last 5 days’ average volume. The cumulative open interest(COI) for the day stood at 12.87 Million. The weekly COI is showing a fall of 7%(WoW) and is placed below the average of the last 2 months average. So we may infer that even though prices have fallen, the strength in the fall may not be there.

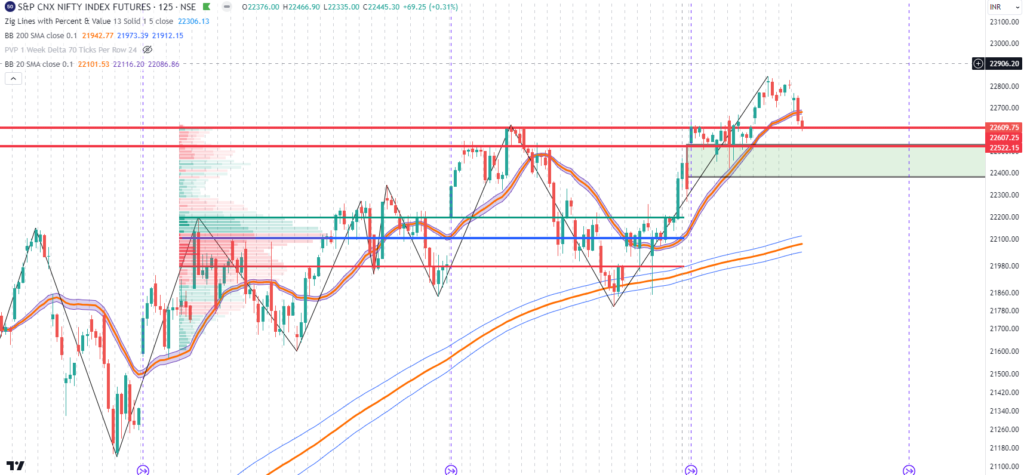

The price analysis of the chart indicates that some more correction in Nifty’s prices may be expected and may fall towards 22500-450 levels, which may be considered as a major support area. This zone(22500-450) has experienced major buying in the recent past(28th March) and provides a high-probability support zone if prices touch those levels.

The momentum in Nifty may remain subdued due to low open interest but unless the support zones are breached the trend may continue to remain sideways with a bullish bias.

Traders may experience three scenarios in the next few forthcoming sessions

Scenario 1: Nifty may take support at the support zone of 222500-450 and move towards higher levels of 22650-700 during the week.

Scenario 2: Nifty may breach the support zone of 22500-450 with higher than average volume and may touch 22100-22000 levels during the week.

Scenario 3: Nifty may breach the immediate resistance of 22750 without falling towards the support zone(with above-average volumes and may touch higher levels of 22850-900 during the week.

Disclaimer: Tradewithvolume is not an investment adviser registered with SEBI. The information presented here is for educational/analytical purposes. Readers’ discretion is requested for acting on the information. The information presented on the website is not for buying/selling recommendations and is only for informational/educational purposes