Nifty futures on Thursday (25th Jan) traded weak to close at 21352.6, thereby losing 0.58%. The major losers for the day were Tech Mahindra(-6.1%), Cipla(-3.37%), and Bharati Airtel(-2.47%).

The volume for the day was 7.258, which was around the average levels. The cumulative open interest(COI) was at 15.83 Million, above the 20D average numbers. The COI increased by 5.3% over the previous day’s numbers supporting the addition of shorts in the market.

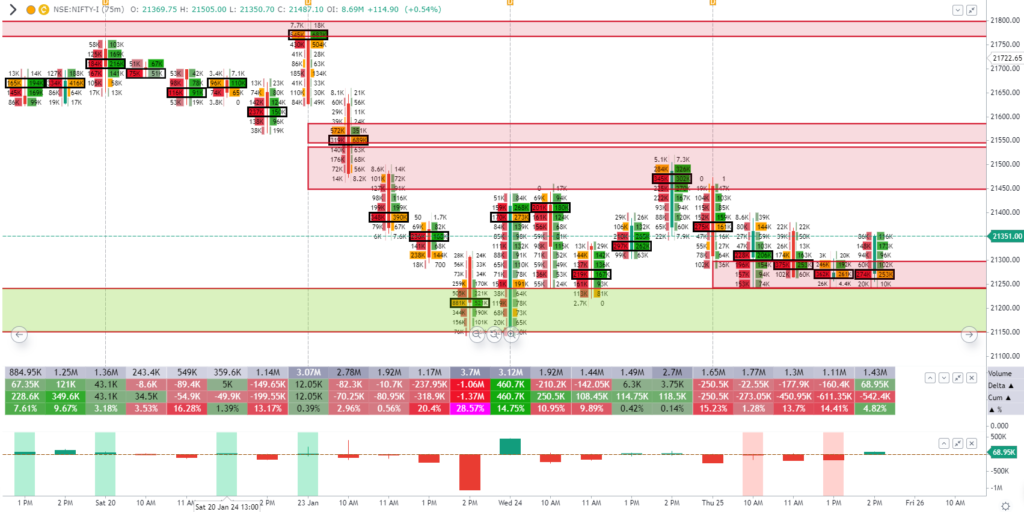

The price analysis of the chart indicates that the prices have been trading in a range owing to the forthcoming Bharat’s “Intermin Budget 2024” and the “US Fed’s Interest Rate Decision” this week. The sideways movement in the index futures may continue in the forthcoming trading sessions unless the support or resistance gets breached.

The order flow chart analysis suggests the resistance is placed at the 21450-540 zone and support at 21240-150 zone. Unless these levels are breached, the index futures may continue to trade in a range.

Traders may experience three scenarios in the next few forthcoming sessions

Scenario 1: Nifty may break the resistance of 21450-540 with above-average volumes and move towards the next resistance of 21750-800

Scenario 2: Nifty may remain range bound around 21500-200 till and break-out is confirmed

Scenario 3: Nifty may breach the support of 21150-200 and fall towards the next support of 21850-900.

**Note: To stay updated with “Nifty futures”, do join our Telegram channel: http://tinyurl.com/volumetrader

Disclaimer: Tradewithvolume is not an investment adviser registered with SEBI. The information presented here is for educational/analytical purposes. Readers’ discretion is requested for acting on the information. The information presented on the website is not for buying/selling recommendations and is only for informational/educational purposes