Nifty futures on Friday (12th Jan) remained bullish to close at 21947, gaining around 1.14% for the day. The major gainers were Infosys (7.93%), ONGC(5.45%), and Tec Mahindra(4.69%). The advance to decline stood at 32:18 for the day.

The volume for the day stood at 7.546 million, which was above the average volume. The cumulative open interest stood at 13.80 million, which was a gain of 4% over the previous day. The cumulative delta for the day stood at 985K (positive), indicating bullishness in the forthcoming sessions if the index sustains above the immediate resistance.

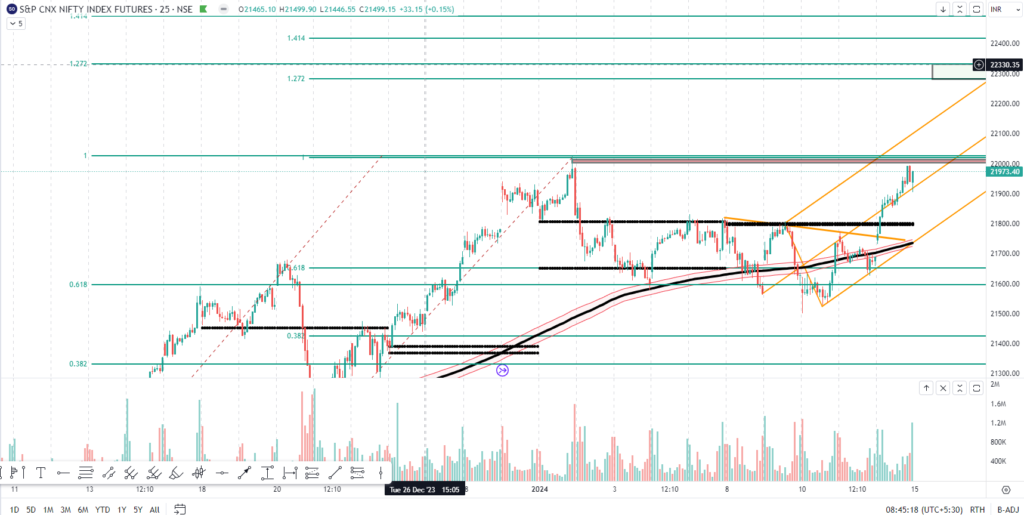

Price action analysis of the Nifty futures chart indicates that on Friday the prices have broken out the short-term trendline and followed the “pitchfork” toward the uptrend. The “imbalance”‘ chart analysis indicates the immediate resistance is placed at 22005-22020 levels, any breach of the level may pull the prices towards 22300 levels in the next few trading sessions.

Traders may experience two scenarios in the next few forthcoming sessions

Scenario 1: The index may breach the resistance of 22005-22020 and move towards the next target zone of 22300

Scenario 2: The index may experience re-selling at 22005-22020 level and experience some selling towards the lower level of 21750-700

**Note: To stay updated with “Nifty futures”, do join our Telegram channel: http://tinyurl.com/volumetrader

Disclaimer: Tradewithvolume is not an investment adviser registered with SEBI. The information presented here is for educational/analytical purposes. Readers’ discretion is requested for acting on the information. The information presented on the website is not for buying/selling recommendations and is only for informational/educational purposes