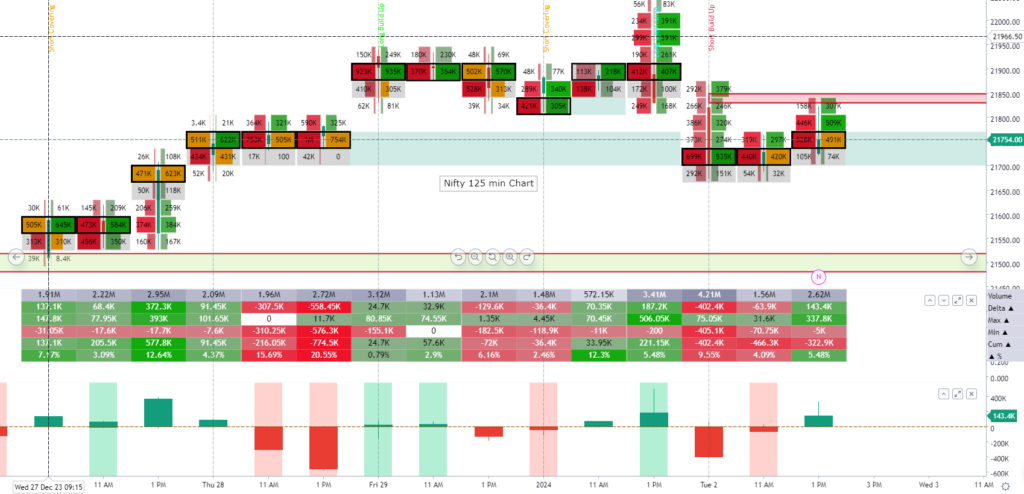

Nifty futures on 2nd January moved as expected and lost around 0.6% to close around 21756. The major laggards in the index were Eichermotors, Mahindra & Mahindra, and Ultra Tech Cements, which lost 3.6%,2.77%, and 2.48% respectively.

On Tuesday the volumes picked up as the index futures fell. It stood at 8.392 Million much higher than average volumes. The cumulative open interest for the day stood at 13.02 Million, thereby experiencing a fall of 5%.

At present the futures are hovering around the initial support of 21750 (as mentioned in our weekly analysis) but the strong seller volumes at the initial support, support our weekly view of the nifty futures moving the value buy levels of 21500-550.

In the next few forthcoming sessions, we expect nifty futures to continue moving down towards 21550-500 levels and may get support at those levels.

Traders may experience two scenarios in the next few forthcoming sessions.

Scenario 1: Nifty may move towards lower levels of 21600-550 and become stagnant at those levels before starting an up move.

Scenario 2: Nifty may breach the resistance of 21850-860 with high volumes and move up.

**Note: To stay updated with “Nifty futures” updates do join our Telegram channel: https://t.me/twvol