Nifty futures experienced some profit booking at higher levels on Friday to lose around 0.3% and close around 21999. The major laggards for Nifty were BPCL, ONGC, and SBI which lost around 3.25%, 1.56%, and 1.44% respectively.

On Friday the volumes experienced a dip (though higher than long term average) at 6.354M with the onset of new monthly expiry. The cumulative open interest (COI) for the day stood at 13.81M a fall of 20.6% from the previous day. A fall in open interest and a fall in prices supports “long unwinding” which may continue in the forthcoming sessions as “long traders” may hunt for “value buy” levels.

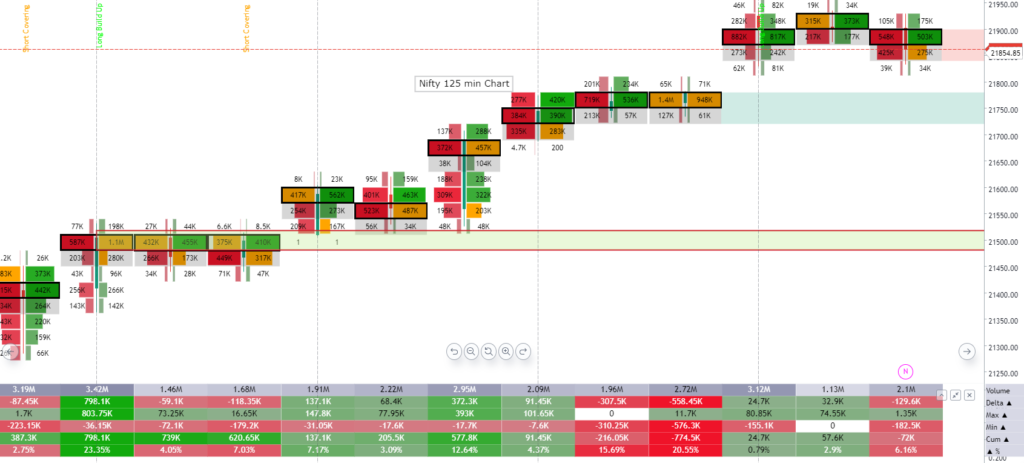

The “imbalance chart analysis” of Nifty-125 minute chart, shows that “value buy” stands at 21550-500 levels and a pullback towards those levels may not be overlooked.

In the next few forthcoming sessions, traders may expect Nifty may experience some correction towards 21750 and if it is supported by considerable volumes a further downside towards 21500 levels may be experienced in the index.

Traders may experience two scenarios for the week.

Scenario 1: Nifty may move towards lower levels of 21750 and if supported by higher volume may move towards 21500.

Scenario 2: Nifty may continue to move higher from present levels if buying persists with “higher volume”.

**Note: To stay updated with “Nifty futures” updates do join our Telegram channel: https://t.me/twvol