Nifty 50 experienced some selling yesterday due to some profit booking at higher levels in Banking and IT sector, pulling down the index to close at 21462, losing around -0.37% in the process. Major losers were ICICI bank (-1.54%), ITC (-1.43%) and Tech Mahindra (-1.10%).

As effect of last week’s FED’s decision wanes off, some profit booking may not be ruled out in sectors which have experienced tremendous momentum due to it, though the overall trend still remains bullish.

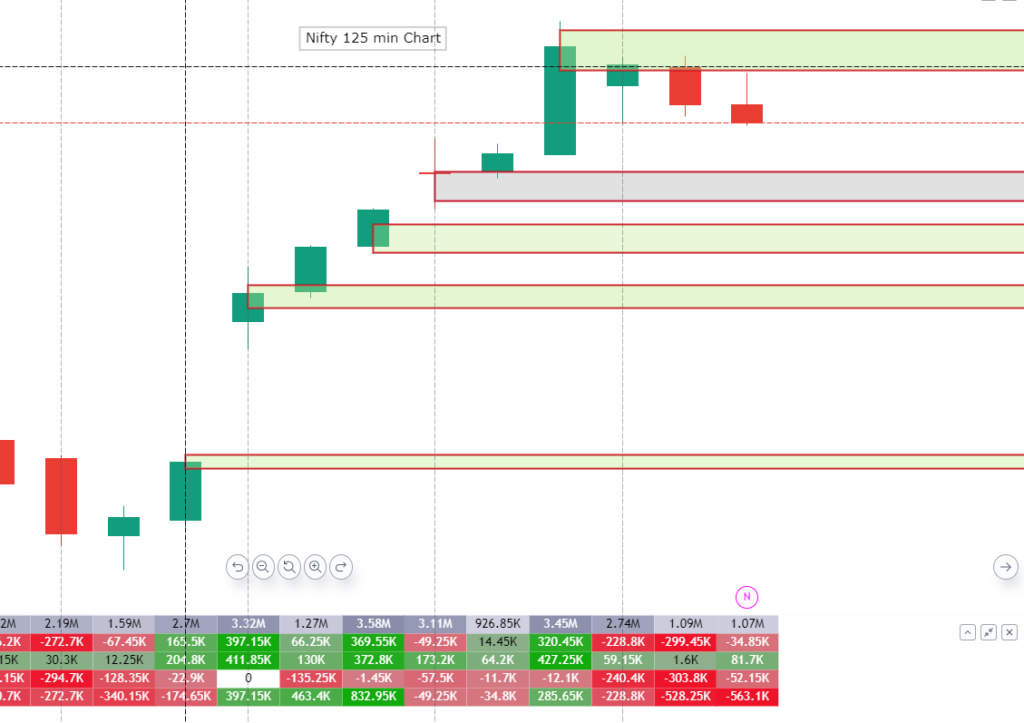

Technically, Nifty is in a bullish phase though some profit booking may not be ruled out at present levels pulling down the index towards the demand zones. Though yesterday the index experienced some selling but it was not supported by “big” volume. The volume for the day stood at 4.901M which is less than 5-day average volume, which supports our initial hypothesis of the index still being in the bullish phase.

Traders may experience two scenarios in the forthcoming days in Nifty:

Scenario 1(Pull Back-most likely): Nifty may pull back towards the demand zone of 21400-350, wherein further buying may start for higher levels of 21500-600.

Scenario 2(Breakout): Nifty may break-out the level of 21580-600 (a major resistance) for higher levels of 21850-900.